|

| As an in-house or M&A lawyer, you need to pay close attention to the industry trends, make precise judgments on the risks and opportunities, and wholly grasp the process of Merger & Acquisition. The practical experience accumulated over time is indispensable for this. “Lexis® Practical Guidance - Merger & Acquisition” is devoted to building a platform to gather the experience and wisdom of the front-line in-house lawyers, so as to realize the scale effect and help you to achieve your success. |

|

|

| The content is comprehensive, and focused on the key points. |

| M&A process |

Different entities |

Special issues |

- M&A methods

- Preliminary negotiation for M&A

- Due diligence investigation

- Implementation of M&A

- Integration after M&A

|

- M&A of state-owned assets

- M&A of listed companies

- M&A of NEEQ-listed companies

- M&A by foreign capitals

- M&A of foreign-invested companies

- Offshore M&A

|

- Taxes involved in M&A

- Anti-trust review of M&A

|

|

| |

| Type of Content |

|

|

| Practical guidance |

|

| The M&A experts interpret the relevant laws and regulations on the basis of practical cases, analyze the key and difficult issues, summarize the practical experiences, and review the operational risks. |

|

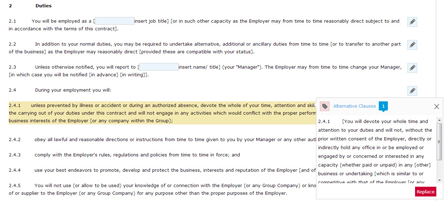

| Contract Templates |

|

| Over 200 high-quality contract templates covering the whole process of M&A, including comments on document drafting, alternative clauses as well as the English translation. |

|

|

|

| Checklist |

|

| Provisions of law + summary of practical experience, “One-time notification” of the legal issues relating to M&A. |

| |

| Flowchart |

|

| This presents the legal issues involved in the whole process in drawings and figures, so that you can easily understand each part of the process. |

|

|

|

|

|

| Many convenient tools focusing on the practice |

|

|

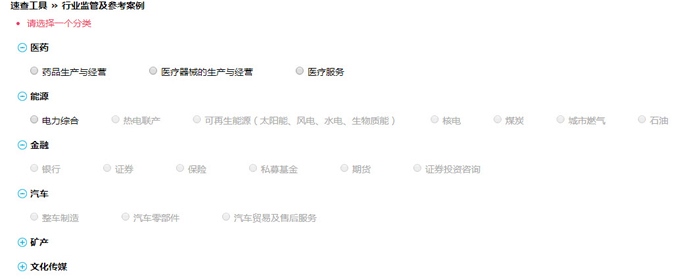

| Tools for quick inquiry |

|

★Industry supervision checked with one click: Collection of industry regulations + industry approvals + prospectuses of listed companies in the same industry

★Due diligence investigation, indispensable for M&A: Analysis of over 300 issues frequently encountered in due diligence investigation + reminder of risks + solutions + similar cases of listed companies for reference

★Tax issues related to M&A, eliminating the weakness of lawyers: Taxes involved in different M&A solutions + reminder of relevant tax risks |

|

|

|

| Analysis of actual M&A cases |

|

★Background of transaction + summary of solutions + analysis of legal issues

★Comment in one sentence, enabling you to quickly grasp the actual M&A cases |

|

| Guidance for offshore M&A |

|

★Introduction of M&A law and supervision of 20 hot countries and/or regions

| Islamic Republic of Pakistan |

South Korea |

South Korea |

| Malaysia |

Mexico |

The Republic of Cyprus |

| Japan |

Switzerland |

Taiwan |

| Ukraine |

Hong Kong |

India |

| Indonesia |

The United States of America |

Germany |

| United Kingdom |

Singapore |

Australia |

★Original M&A contracts from the UK, USA, and HK + summary and analysis in Chinese

★Written by experienced Chinese and foreign lawyers.

| RIAA LAW (Islamic Republic of Pakistan) |

Lee&Ko(South Korea) |

Bentsi-Enchill, Letsa & Ankomah (Ghana) |

| Shearn Delamore & Co. (Malaysia) |

Basham, Ringe y Correa, S.C. (Mexico) |

Anastasios Antoniou LLC (The Republic of Cyprus) |

| Anderson, Mori & Tomotsune (Japan) |

Niederer Kraft & Frey Ltd (Switzerland) |

Walder Wyss Ltd(Switzerland) |

| Bär & Karrer AG(Switzerland) |

Baker & McKenzie (Taiwan) |

Asters(Ukraine) |

| WINSTON & STRAWN (Hong Kong) |

Trilegal (India) |

Ali Budiardjo, Nugroho, Reksodiputro (Indonesia) |

| ZHONG LUN LAW FIRM(China) |

ANJIE LAW FIRM(China) |

JINCHENG TONGDA &NEAL(China) |

|

|

|